Personal Auto Insurance

Choosing a Personal Auto insurance policy these days can feel overwhelming. How do I know what coverages I need or how much coverage I need?

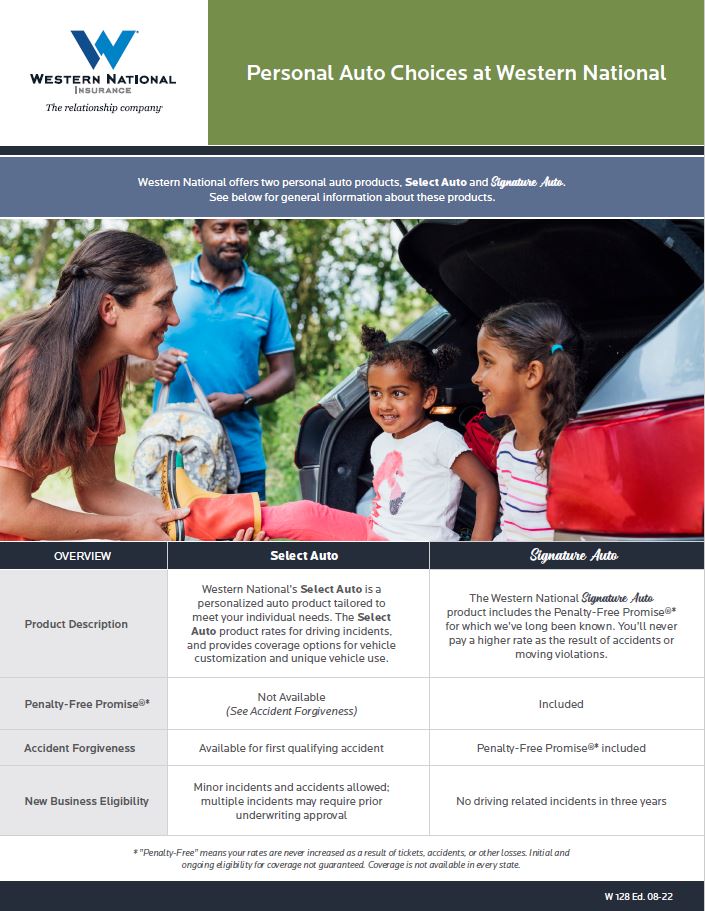

At Western National, we have options to provide the coverages policyholders may want for their driving needs. We offer excellent Personal Auto coverages at a fair price. For violation and accident-free households, our Signature Auto Program will provide our Penalty-Free Promise®, in which you will never pay a higher rate as the result of future accidents or violations — a benefit that some competitors now attempt to copy, though we've been offering it for over 50 years! We also have our Select Auto Program that can provide additional flexibility and broader coverage options for vehicle customization and unique vehicle use. With a variety of discounts to make your premium even more affordable, and an experienced claim staff ready to provide outstanding service, our Personal Auto Insurance program provides the high level of protection you want and deserve.

Your Independent Insurance Agent can help you determine the appropriate Personal Auto coverages, discounts, and price for you. If you do not have an Independent Insurance agent, you can find an agent who works with Western National by clicking here.

Features

Western National offers a Personal Auto product that includes many unique benefits at no additional charge, such as:

- Penalty-Free Promise®

- Common Loss Deductible

- Customizing

- Pet Insurance

- Temporary Transportation Expense

- Car Seat Replacement

- Collision with Another Western National Customer

Discounts

- Anti-Theft Devices

- Corporate Vehicle

- Customer Loyalty

- Defensive Driver

- Full Pay Discount

- Good Student

- Multi-Policy

- Multi-Car Discount

- Family Member

Coverages

Personal Auto insurance coverages vary by the limits and requirements of individual states. Western National offers the following coverages subject to those limits and requirements:

- Bodily Injury Liability

- Property Damage Liability

- Personal Injury Protection (No Fault)

- Medical Payments

- Uninsured and Underinsured Motorists

- Collision

- Comprehensive (Other Than Collision)

- Audio, Visual, and Data Electronic Equipment

- Auto Loan/Lease

- Full Glass

- New Vehicle Replacement Cost

- Rental Reimbursement (transportation expenses)

- Roadside Assistance

- Towing & Labor

- Trip Interruption

Getting a Quote

At Western National, we believe in the benefit that Independent Insurance Agents provide to their customers. That’s why our products are sold exclusively through Independent Insurance Agents.

Benefits of choosing an Independent Insurance Agent:

- An Independent Insurance Agent represents many companies and provides you with choices for coverage and pricing.

- An Independent Insurance Agent represents your interests because they are not employees of any one insurance company.

- An Independent Insurance Agent is a real person you can trust to help you out when you have a question or a claim situation.

Contact your Independent Agent to get a quote for our products. If you don't already have an Independent Insurance Agent, click here find an agent in your area who works with Western National.

Some coverages may not be available in all states. Please contact your Independent Insurance Agent if you have questions.

Homeowner/Condo Unit Owner/Renter Insurance

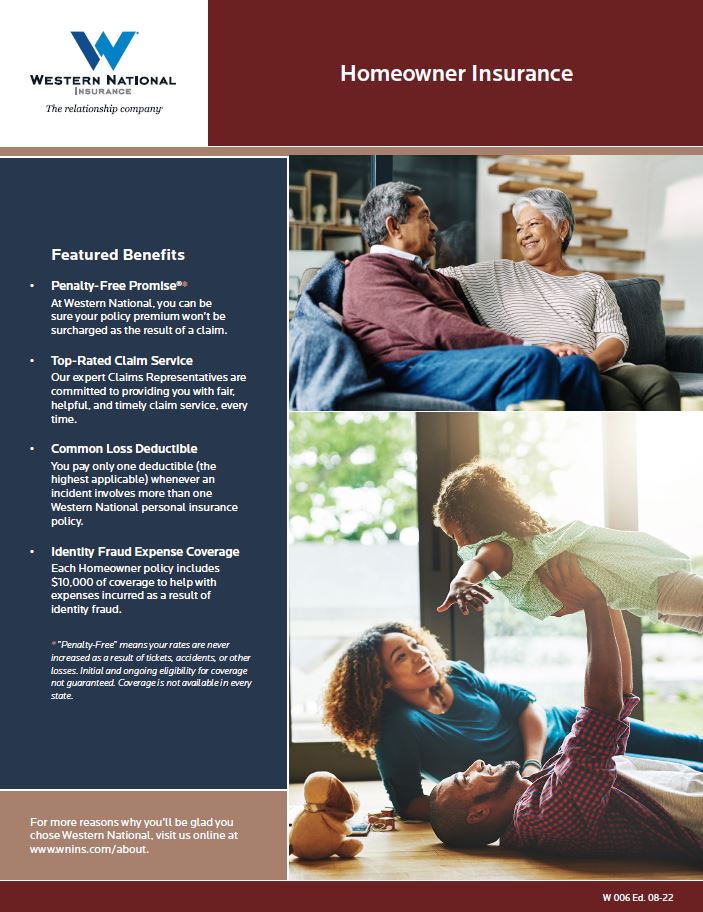

Whether you're a homeowner, renter, or own a condo, Western National understands that your property — whether it be real estate, personal property, or both — is special and valuable. We believe it deserves the protection to match.

With a variety of options tailored to meet your individual circumstances, we can cover just about everything. Our Signature Home and Select Home programs provide a range of customizable insurance options. The Penalty-Free Promise®, which guarantees you won’t pay a higher rate as the result of claims, is also included in our Signature Home program. The variety of discounts we offer can help make your premium even more affordable, and our experienced claim staff is always ready to provide the outstanding service you want and deserve.

Your Independent Insurance Agent can help you determine the right fit of coverages, discounts, and price. If you do not currently have an Independent Insurance Agent, you can find an agent who works with Western National by clicking here.

Features

Western National offers a variety of Homeowner coverages that include many unique benefits at no additional charge, such as:

- Penalty-Free Promise®

- Common Loss Deductible

- Watercraft Liability

- Identity Fraud Expense Coverage

Discounts

Coverages

Homeowner/Renter insurance coverages vary by the limits and requirements of individual states. Western National offers the following coverages subject to those limits and requirements:

- Coverage A - Residence (Homeowner)

- Coverage B - Related Private Structures (Homeowner)

- Coverage C - Personal Property

- Coverage D - Additional Living Expenses and Loss of Rent

- Coverage L - Personal Liability

- Coverage M - Medical Payments to Others

- Other coverages may be optional or included (depending on the program and form):

- Assisted Living

- Business Property

- Computer

- Credit Card

- Cyber Liability

- Debris Removal

- Earthquake

- Homeowner Equipment Breakdown

- Identity Fraud Expense

- Golf Cart

- Guns

- Golf Equipment

- Jewelry, Watches, Furs

- Loss Assessment Coverage

- Office, Professional, Private School or Studio Occupancy

- Other Structure On and Off Premises

- Personal Injury

- Personal Property - Special Coverage

- Refrigerated Food Spoilage

- Replacement Cost - Residence

- Replacement Cost - Personal Property

- Water Damage - Sewers, Drains, and Sumps

Getting a Quote

At Western National, we believe in the benefit that Independent Insurance Agents provide to their customers. That’s why our products are sold exclusively through Independent Insurance Agents.

Benefits of choosing an Independent Insurance Agent include:

- An Independent Insurance Agent represents many companies and provides you with choices for coverage and pricing.

- An Independent Insurance Agent represents your interests because they are not employees of any one insurance company.

- An Independent Insurance Agent is a real person you can trust to help you out when you have a question or a claim situation.

Click here to get a quote for our products by finding an Independent Insurance Agent in your area.

Some coverages may not be available in all states. Please contact your Independent Insurance Agent if you have questions.

Dwelling Property

Do you own multiple properties? Western National offers Dwelling Property insurance to help policyholders cover various types of dwellings that their Homeowner insurance does not cover. Some properties that can be covered by Dwelling Property insurance include seasonal properties and properties that you rent to others. Dwelling Property insurance is available as a separate policy and requires a Western National Homeowner/Condo Unit Owner/Renter policy.

Your Independent Insurance Agent can help you determine if Dwelling Property insurance is right for you. If you do not currently have an Independent Insurance Agent, you can find an agent who works with Western National by clicking here.

Coverages

Dwelling Property insurance coverages vary by the limits and requirements of individual states. Western National offers the following coverages subject to those limits and requirements:

- Coverage A - Residence

- Coverage B - Related Private Structures

- Coverage C - Personal Property

- Coverage D - Fair Rental Value

- Coverage E - Additional Living Costs

- Other coverages may be optional or included (depending on the program and form):

- Condo (Improvements, Alterations, and Additions)

- Business Property

- Inflation Guard

- Loss Assessment

- Ordinance or Law

- Sewer and Water Backup Coverage

- Special Coverage for Condos

- Theft Coverage

Getting a Quote

At Western National, we believe in the benefit that Independent Insurance Agents provide to their customers. That’s why our products are sold exclusively through Independent Insurance Agents.

Benefits of choosing an Independent Insurance Agent include:

- An Independent Insurance Agent represents many companies and provides you with choices for coverage and pricing.

- An Independent Insurance Agent represents your interests because they are not employees of any one insurance company.

- An Independent Insurance Agent is a real person you can trust to help you out when you have a question or a claim situation.

If you don't already have an Independent Insurance Agent, click here find an agent in your area who works with Western National.

Some coverages may not be available in all states. Please contact your Independent Insurance Agent if you have questions.

Recreational

Everyone knows that the term “toys” doesn’t just apply to fun things for kids. Whether you own a motorcycle, all-terrain vehicle (ATV), utility task vehicle (UTV), boat, or snowmobile, Western National offers recreational vehicle insurance that can help you protect your toys and enjoy your favorite pastimes for years to come. Our Road & Trail and Watercraft policies are available to our customers who have a Western National Personal Auto policy.

Watercraft Insurance

Nothing beats being out on the water – that is, except adding the peace of mind that comes from knowing your watercraft is protected by insurance. Our Watercraft insurance policy provides customizable coverage for your watercraft and additional equipment.

Road & Trail Insurance

Whether you prefer the open road or having no road at all, Western National has the policy to protect your ride. Our Road & Trail insurance program provides coverage for a range of vehicles, including ATVs, autocycles, mopeds, motorcycles, snowmobiles, and UTVs. Western National offers coverage options that can be customized to your needs, including coverage for carried contents, safety riding apparel, trailers, custom equipment, and more.

Your Independent Insurance Agent can help you determine which policies are right for you. To find an agent, click here.

Getting a Quote

At Western National, we believe in the benefit that Independent Insurance Agents provide to their customers. That’s why our products are sold exclusively through Independent Insurance Agents.

Benefits of choosing an Independent Insurance Agent:

- An Independent Insurance Agent represents many companies and provides you with choices for coverage and pricing.

- An Independent Insurance Agent represents your interests because they are not employees of any one insurance company.

- An Independent Insurance Agent is a real person you can trust to help you out when you have a question or a claim situation.

If you don't currently have an Independent Insurance Agent, you can find an agent who works with Western National by clicking here.

Some coverages may not be available in all states. Please contact your Independent Insurance Agent if you have questions.

Personal Umbrella Insurance

Lawsuits against individuals are common and can sometimes reach devastating levels. While your Personal Auto and Homeowner/Condo Unit Owner/Renter policies may provide coverage to help with these costs, it doesn't take much for certain lawsuit amounts to exceed the limits of those policies. For example:

- You cause an auto accident that permanently disables another driver.

- Your pet dog bites a child, causing physical and psychological harm.

- Your son or daughter is accused of cyber bullying, resulting in a defamation lawsuit.

- You accidentally injure someone while boating or hunting.

These are just a few examples of the types of personal liability lawsuit situations that tend to result in very severe lawsuit amounts. A Personal Umbrella policy protects you in these situations by providing an extra layer of liability coverage over that provided by your other personal insurance policies. The Personal Umbrella insurance policy increases certain limits to $1 million or more, providing the extra coverage that can help secure individuals and families from severe liability costs. This affordable policy is available to policyholders who have both a Personal Auto policy and a Homeowner/Condo Unit Owner/Renter policy from Western National.

Uninsured and Underinsured Motorists coverage can also be added to a Personal Umbrella policy to provide an extra layer of protection for you and your family. If you or a resident family member were to get in an accident with a driver who is at fault but who does not have insurance (uninsured) or does not have enough insurance (underinsured) to cover your injuries, this optional coverage could provide the extra funds to help pay those damages.

Your Independent Insurance Agent can help you determine if Personal Umbrella Insurance is right for you. If you don't currently have an Independent Insurance Agent, you can find an agent who works with Western National by clicking here.

Additional Benefits

- Worldwide Personal Liability Coverage

- Bodily Injury & Property Damage Liability Coverage

- Personal Injury Liability Coverage

- Legal Defense

Getting a Quote

At Western National, we believe in the benefit that Independent Insurance Agents provide to their customers. That’s why our products are sold exclusively through Independent Insurance Agents.

Benefits of choosing an Independent Insurance Agent include:

- An Independent Insurance Agent represents many companies and provides you with choices for coverage and pricing.

- An Independent Insurance Agent represents your interests because they are not employees of any one insurance company.

- An Independent Insurance Agent is a real person you can trust to help you out when you have a question or a claim situation.

Click here to get a quote for our products by finding an Independent Insurance Agent in your area.

Some coverages may not be available in all states. Please contact your Independent Insurance Agent if you have questions.

Commercial Automobile

Western National insures commercial vehicles in conjunction with other commercial policies. Standard coverages for Commercial Auto include:

- Combined single limit insurance for Bodily Injury and Property Damage

- Personal Injury Protection (PIP) or Medical Payments

- Uninsured and Underinsured Motorist

- Comprehensive

- Collision

- Other miscellaneous coverages are also available

Commercial Package Policy (CPP)

The CPP policy is a valuable and cost-effective way to combine many different lines of business into one package. The Fire and Allied Lines, Crime, ISO Inland Marine, and General Liability coverages are eligible for the package.

Commercial Umbrella

Western National writes Commercial Umbrella policies in conjunction with other commercial insurance. This policy adds higher limits of liability beyond General Liability and Commercial Auto. One of the requirements of the Commercial Umbrella program is that Western National insures your primary underlying coverages.

Contractors E&O

Western National's Contractors E&O form provides coverage on a claims-made basis for damages resulting from the policyholder's negligent act, error, or omission arising from the business operation described in the declarations or from a defect in material or product sold or installed by the policyholder while acting in the business.

Cyber Liability

With the increased use of e-commerce; web-based file storage; and the proliferation of smart phones, laptops, and tablets in businesses of all sizes, data security risks are growing exponentially. Recognizing this increasing risk, we developed a Cyber Liability coverage program that provides both First Party and Third Party Protection for our new and existing commercial policyholders. Cyber Liability limits are available up to $1,000,000 and our program includes these ten core coverage components:

- Network Security and Privacy Insurance – coverage for both online and offline information, virus attacks, denial of service, and failure to prevent transmission of malicious code

- Regulatory Defense and Penalties – coverage for defense costs and fines and penalties resulting from government investigations

- Privacy Breach Response Costs – coverage for costs incurred to notify affected individuals

- Network Asset Protection – coverage for income loss, business interruption expenses, and costs to restore data that is damaged

- BrandGuard - coverage for lost revenue resulting from a cyber breach

- Multimedia Insurance – coverage for copyright/trademark infringement

- Cyber Extortion – will pay extortion expenses and monies as a direct result of a credible cyber extortion threat

- Cyber Terrorism – coverage for income loss and interruption expenses as a result of the interruption of the policyholder’s computer system due to a cyber terrorism attack

- Payment Card Industry Data Security Standard (PCI/DSS) fines and penalties

- Cyber Crime - coverage for losses incurred due to (1) wire transfer fraud, (2) fraudulent use of an insured telephone system, and (3) phishing schemes that impersonate your brand, products, or services, including the costs of reimbursing your customers for losses they sustain as a result of such phishing schemes

Employment Practices Liability

Western National offers Employment Practices Liability (EPL) coverage for eligible commercial policies, making it easier and affordable for employers to protect themselves against these increasingly prevalent claims. This EPL program protects employers against claims of discrimination, sexual harassment, wrongful termination, and other unlawful employment practices.

To access Western National's EPL resource website (EmployerProtectionNet), click here.

EPL website resources:

Fire and Allied Lines

Western National provides the many types of insurance necessary to protect your business from the perils of fire, theft, wind, loss of income, etc. Coverage for building, building personal property, and personal property of others is standard under the policy. In addition, Western National has a Property Enhancement Endorsement that expands many of the coverages available under the basic property form. The following coverages are subject to expanded limits:

- Accounts receivable

- Back-up of sewers

- Changes in temperature or humidity

- Distance from described premises

- EDP (computer)

- Extra expense

- Fire extinguisher recharge

- Inventory and appraisals of loss

- Lock replacement

- Newly acquired or constructed property

- Ordinance or law

- Off-premises power failure

- Outdoor property

- Personal effects

- Property off premises (includes exhibition)

- Property in the custody of salespersons

- Property of others

- Property in transit

- Reward reimbursement

- Signs (attached and unattached)

- Utility services (off-premises power failure)

- Valuable papers

Western National also includes Equipment Breakdown insurance as part of our property policy, which helps our policyholders avoid potentially disastrous coverage gaps. Equipment Breakdown insurance covers the physical and financial damage stemming from an insured equipment failure. It's the bottom-line protection essential for today's technology-driven world. Western National's policy pays for losses that aren't typically covered by standard property policies. Our insurance includes:

- Mechanical breakdown

- Cloud Computing Service Interruption

- Electrical arcing

- Hot water heater loss or damage

- Microelectronics Coverage

- Off Premises Coverage

- Public Relations Coverage

- Steam boiler, piping, engine, or turbine explosion

- Steam boiler loss or damage

General Liability

Western National's General Liability policy offers coverage for the following:

- Advertising Liability

- Bodily Injury

- Damage to Premises Rented to You

- Medical Expense

- Personal Injury

- Property Damage

Inland Marine

Western National provides most of the typical Inland Marine coverages. Listed below are some of the more common ones:

- Accounts Receivable

- Bailees' Coverage

- Builders' Risk

- Cargo

- Contractors' Equipment

- EDP (computer)

- Installation Floater

- Signs

- Transportation Floater

- Valuable Papers

Manufacturer's E&O

Western National’s Manufacturer’s E&O form provides liability coverage on a claims-made basis for damages resulting from the policyholder’s faulty workmanship, materials, or products. It is designed to bridge the gap in Product Liability coverage created by certain business risk exclusions.

Specialty

Western National offers niche insurance coverages through its subsidiary company Pioneer Specialty. Currently, Pioneer Specialty offers carefully crafted, individually underwritten policies for a number of specialty business classes, including:

Workers' Compensation

The Workers' Compensation policy pays for medical expenses and lost wages in amounts determined by state law. All employers are required to either purchase Workers' Compensation insurance or be self-insured. Employers can work with Loss Control Representatives and Claim Administrators at Western National to monitor and manage their claims. Western National offers the following Workers' Compensation programs:

- Guaranteed cost

- Deductible programs

- Dividend programs

- Flat

- Variable

Surety

Western National is a full-service contract and commercial surety market using a Hub and Spoke service model. Our home office, based in Edina, Minnesota, services 45 states across most of the U.S. with remote underwriting teams in Oklahoma City, OK; Des Moines, IA; and Phoenix, AZ. Our strong commitment to providing a consistent and stable surety market, coupled with excellent customer service and a common-sense underwriting approach, enables us to develop, cultivate, and maintain strong and lasting relationships with our agents and customers. Western National is rated A+ (Superior) Class X by A.M. Best and has a Treasury Listing in excess of $72,000,000.

Contract Surety

We offer several surety products designed to meet the needs of all types of contractors from large, sophisticated contractors with continuous bond needs to small contractors with infrequent needs or even contractors needing their first bond.

Standard and Preferred Programs up to $15 million single and $30 million bonded aggregate with multiple flexible rating plans.

ContractXpress and ContractXpress Xtra - Offering bonds up to $3,000,000 without C.P.A. reviewed or audited financial statements, and bonds up to $750,000 can often be underwritten primarily with an application and a credit investigation.

U.S. Small Business Administration (SBA) bond guarantee program - For emerging contractors that are beginning to bid on public works projects and in building their financial resources before graduating them into a standard program.

Commercial Surety

Western National underwrites a wide variety of Commercial Surety Obligations with highly competitive rates and commissions:

- License and Permit

- Court

- Fiduciary

- Miscellaneous

- Public Official

- Business Indemnity

- "Non Construction" Commercial Performance Bonds for Service Industries

If you would like to verify a surety bond or if you are inquiring about a surety agency appointment, please email surety@wnins.com or contact us at (800) 862-6070.

Western National Program Business

Pioneer Specialty Insurance is now Western National Program Business. Western National Program Business offers the same products, working with the same underwriting team. Thank you for your partnership!

Home Health Care

Western National's in-home health care insurance team approaches your work and property risks with the same high level of care and attention you offer your clients.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Home Health Care Supplemental Application (PDF)

Available Coverages

Workers' Compensation (except in ND, OR, and WA)

Eligibility

Western National seeks to insure home health care / companion care operations that have been in business a minimum of three years with an established payroll consisting of Personal Care Attendants, Home Health Care Aides, and Nurses that assist clients in their own residences with activities of daily living and limited medical care.

Recycling & Dismantling

Western National's recycling and dismantling insurance team approaches your work and property risks with the same high level of care and attention you offer your clients.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Recycling & Dismantling Supplemental Application (PDF)

Available Coverages

- Cargo

- Commercial Auto Liability / Physical Damage

- Crime

- Employee Benefit Liability

- Employer's Practices Liability (EPL)

- Equipment Breakdown

- General Liability

- Inland Marine (outside only)

- Limited Property coverage is available – contact Underwriting for information

- Umbrella

- Workers' Compensation

Eligibility

Western National seeks to insure recycling and dismantling operations that meet the following guidelines:

- Metal recyclers and wholesalers

- Operations that take in and process commercial and large consumer metal scrap, industrial metal scrap, and other metal materials

- Operations that break up, sort, shred, bale, and wholesale scrap iron and steel with the use of processing equipment such as cranes, hydraulic shears, and baling equipment

- Auto dismantlers / salvage yard

- Private passenger and commercial auto salvage and dismantling operations both for scrap metal and parts sale

- Document shredding operations

- Document collection, destruction / shredding, and bailing operations

Refuse Haulers

Western National's specially designed insurance program for refuse haulers is tailored to protect the work and property of your unique collection operation.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Commercial Auto Supplemental Application (PDF)

Available Coverages

- Cargo

- Commercial Auto Liability / Physical Damage

- Crime

- Employee Benefit Liability

- Employer's Practices Liability (EPL)

- Equipment Breakdown

- Flexible Deductible Options

- General Liability

- Inland Marine

- Medical Payments

- Personal Computers, EDP Equipment, Data, Media, and Phones

- Property

- Umbrella

- Workers' Compensation and Employer's Liability (only for accounts with minimal / no manual curbside collection; except in OR and WA)

- Enhancement endorsements available for General Liability, Property, and Auto

Eligibility

Western National seeks well-established refuse collection operations of above-average quality that:

- Utilize multi-line / package policies

- Have at least three years of industry experience

- Have established practices in place for: driver selection and hiring, vehicle / equipment inspection and maintenance, and safety

- Operate within a 300-mile radius

Independently Owned School Bus Operations

Western National's specially designed insurance program for independently owned school bus operations is tailored to protect the work and property of your unique busing operation.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

School Bus Supplemental Application (PDF)

Available Coverages

- Cargo

- Commercial Auto Liability / Physical Damage

- Crime

- Employee Benefit Liability

- Employer's Practices Liability (EPL)

- Equipment Breakdown

- Flexible Deductible Options

- General Liability

- Inland Marine

- Medical Payments

- Personal Computers, EDP Equipment, Data, Media, and Phones

- Property

- Umbrella

- Workers' Compensation and Employer's Liability (except in ND, OR, and WA)

- Enhancement endorsements available for General Liability, Property, and Auto

Eligibility

Western National seeks to insure independent contractor school bus operations that:

- Provide public / private K-12 school bus service

- Have been in business for at least three years

- Have a fleet size up to 100 vehicles per location

- Have formal driver selection / hiring standards

- Have formal inspection / maintenance processes

- Have a formal safety / training program

Septic Services & Installation

Western National's specially designed insurance program for septic service and installation companies is tailored to protect the work and property of your unique operation.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Septic Services and Installation Supplemental Questionnaire (PDF)

Available Coverages

- General Liability

- Contractors E&O

- Employee Benefit Liability

- Employer's Practices Liability

- Property

- Equipment Breakdown

- Inland Marine

- Crime

- Commercial Auto Liability / Physical Damage

- Commercial Auto Pollution Sub-limit

- Umbrella

- Workers’ Compensation

Eligibility

Western National seeks to insure well established septic service and installation operations of above average risk quality that:

- Have at least three years of industry experience

- Have established practices in place for driver / employee safety training

- Have established vehicle and equipment inspection practices

- Derive at least 50% of revenue from septic operations

Portable restroom rental operations are also eligible for this class.

Tree Care

Western National's insurance program is designed for tree care companies and is tailored to protect your unique tree care operation.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Tree Care Supplemental Application (Word Document)

Available Coverages

- Commercial Auto Liability / Physical Damage

- Contractor E&O

- Crime

- Employee Benefit Liability

- Equipment Breakdown

- General Liability

- Herbicide / Pesticide Coverage

- Inland Marine

- Property

- Workers' Compensation

- Enhancement endorsements available

Eligibility

Western National seeks to insure tree care operations that:

- Engage in the care of trees, including trimming, pruning, felling, cabling or bracing, consulting, and herbicide / pesticide treatment

- Have at least five years in business experience

- Have a minimum of three full-time employees

- Provide year-round operations

- Have job site management, safety equipment maintenance, and established practices for hiring

Towing Services

Western National's specially designed insurance program for towing companies is tailored to protect the work and property of your unique towing operation.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Towing Supplemental Application (Word Document)

Available Coverages

- Cargo

- Commercial Auto Liability / Physical Damage (minimum deductible $1,000)

- Crime

- Employee Benefit Liability

- Employer's Practices Liability (EPL) (except in ND, OR, and WA)

- Equipment Breakdown

- Garage Keepers Legal Liability

- General Liability

- Inland Marine

- Medical payments / PIP Deductibles available

- Personal Computers, EDP Equipment, Data, Media, and Phones

- Property

- Umbrella limits up to $2,000,000

- Workers' Compensation (except in ND, OR, and WA)

- Enhancement endorsements available for General Liability, Property, and Auto

Eligibility

Western National seeks to insure towing operations that:

- Utilize multi-line / package policies

- Have at least three years of industry experience

- Have established practices for: driver selection and hiring, vehicle / equipment inspection and maintenance, and safety

- Operate within a 300-mile radius

Truck Body & Trailer Manufacturing

Western National's truck body and trailer manufacturing insurance team approaches your work and property risks with the same high level of care and attention you offer your clients.

Our customizable program offers a variety of coverages and services to fit your unique insurance needs.

Supplemental Application

Truck Body Manufacturing Supplemental Questionnaire (PDF)

Available Coverages

- Cargo

- Commercial Auto Liability / Physical Damage (minimum deductible $1,000)

- Crime

- Drive-Away Collision

- Employee Benefit Liability

- Employer's Practices Liability (EPL) (except in ND, OR, and WA)

- Equipment Breakdown

- Garage Keeper's Physical Damage

- Garage Liability

- General Liability

- Inland Marine

- Manufacturer's E&O

- Open Lot Physical Damage

- Property

- Umbrella

- Workers' Compensation (except in ND, OR, and WA)

- Enhancement endorsements available for General Liability, Property, and Auto

Eligibility

Western National seeks to insure truck body, truck trailer, and truck equipment operations that meet the following guidelines:

Truck Body Manufacturing

- Operations that fabricate specialized truck bodies on pre-manufactured truck chassis. Examples of finished trucks include fire trucks, refuse trucks, tank trucks, and commercial utility trucks.

Trailer Manufacturing

- Operations that manufacture commercial trailers, such as semitrailers, flat-bed trailers, trailers designed to haul equipment, dump trailers, and commercial grade utility trailers.

Truck Equipment Manufacturing / Upfitters

- Commercial and municipal use truck equipment fabricators that build and upfit equipment to commercial trucks, such as commercial grade snow handling equipment, road maintenance equipment, boom attachments, and aerial access equipment.